Original Medicare pays for many, but not all, health care services and supplies. Medicare Supplement Insurance policies, sold by private companies, can help pay your share of some of the health care costs that Original Medicare doesn’t cover, like copayments, coinsurance, and deductibles. Medicare Supplement Insurance policies are also called Medigap policies.

Some Medigap policies also offer coverage for services that Original Medicare doesn’t cover, like medical care when you travel outside the U.S. If you have Original Medicare and

you buy a Medigap policy, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then, your Medigap policy pays its share. You have to pay the premiums for a Medigap policy.

A Medigap policy is different from a Medicare Advantage Plan (like an HMO or PPO) because those plans are ways to get your Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. It’s generally illegal for

an insurance company to sell a Medigap policy to anyone who’s still enrolled in a Medicare Advantage Plan. If you have Medigap and switch to enroll in a Medicare Advantage Plan for the first time, you have the right to change your mind and you’ll have special rights under federal law to buy a Medigap policy if you return to Original Medicare 12 months after you enrolled in the Medicare Advantage Plan.

Remember these important facts

- You must have Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance) to buy a Medigap policy.

- You pay the private insurance company a monthly premium for your Medigap policy in addition to the monthly Part B premium that you pay to Medicare. Contact the insurance company to find out how to pay your Medigap premium.

- A Medigap policy covers only one person. Spouses must buy separate policies.

- Although some Medigap policies sold in the past covered prescription drugs, Medigap policies sold after January 1, 2006, aren’t allowed to include such coverage. If you want prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D) offered by private companies approved by Medicare.

- It’s important to compare Medigap policies since the costs can vary and premiums may go up as you get older. Some states impose limits on how insurance companies “price” or set Medigap premiums.

- The best time to buy a Medigap policy is during your Medigap Open Enrollment Period, when you have the right to buy any Medigap policy offered in your state. This 6-month period begins on the first day of the month in which you’re 65 or older and enrolled in

Part B. Some states require Medigap insurance companies to sell Medigap policies to people under age 65. Check with your State Insurance Department to learn about what rights you might have under state law.

What’s covered?

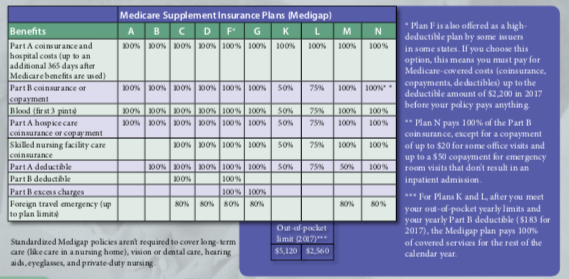

The chart below shows basic information about the different benefits that Medigap policies cover. If a percentage appears, the Medigap plan covers that percentage of the benefit and you’re responsible to pay the rest

What policies are available?

Every Medigap policy must follow federal and state laws designed to protect you, and the policy must be clearly identified as “Medicare Supplement Insurance.” Insurance companies

can sell you only a “standardized” Medigap policy, identified in most states by letters A–N. In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way. For more information, visit Medicare.gov.

All standardized policies offer the same basic benefits, no matter which insurance company sells it, but some offer additional benefits so you can choose which one meets your needs.

Plans E, H, I, and J are no longer available to buy, but, if you already have one of those policies, you can generally keep it. Contact your insurance company for more information.

In some states, you may be able to buy another type of Medigap policy called Medicare SELECT. Medicare SELECT plans are standardized Medigap policies that require you to use specific hospitals and, in some cases, specific doctors or other health care providers to get full supplemental coverage (except in an emergency). If you have Medigap and switch to a Medicare SELECT policy, you have the right under federal law to change your mind within 12 months and switch to a standard Medigap policy.